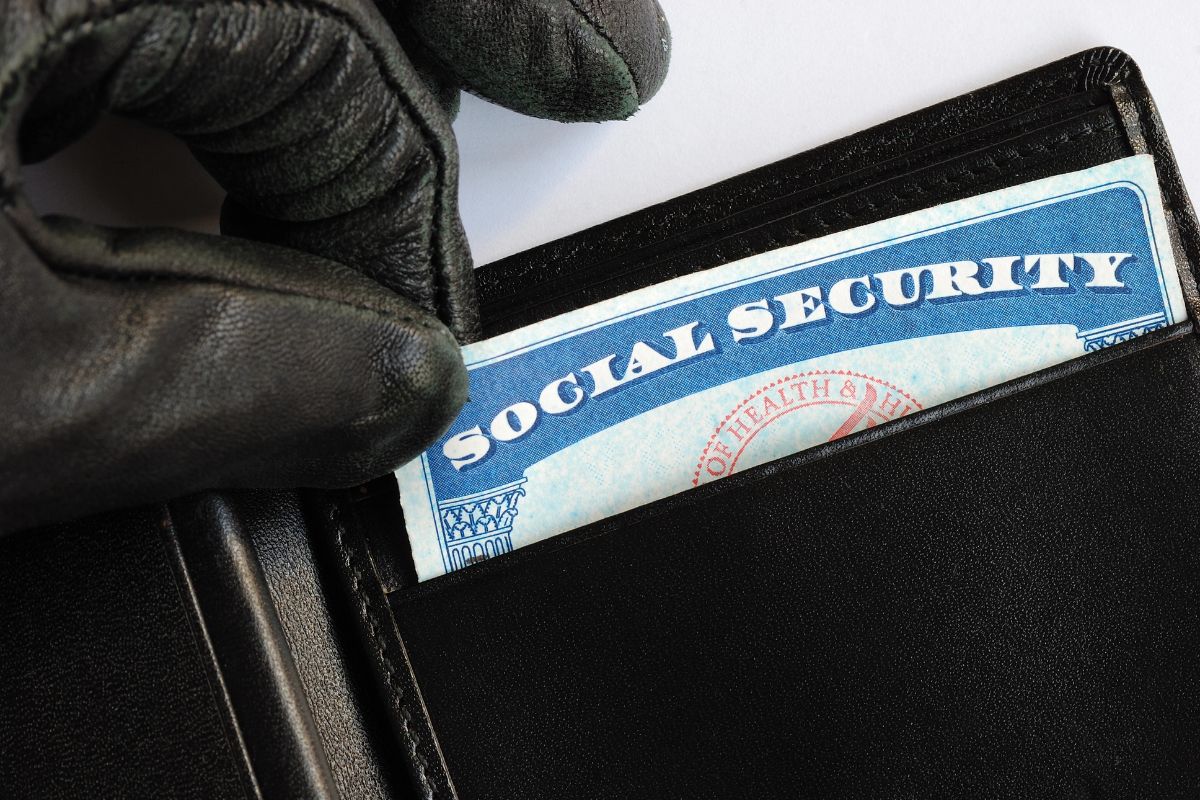

Identity theft is a crime in which someone wrongfully obtains and uses another person’s personal data to open fraudulent credit card accounts, charge existing credit card accounts, withdraw funds from deposit accounts, or obtain new loans. Losses may include not only out-of-pocket financial losses but also substantial costs to restore credit history and to correct erroneous information in credit reports. The best protection against identity theft is to carefully guard your personal information. Below are some tips to help keep your information private and your identity protected.

- Do not share personal information over the phone, through the mail, or over the internet unless you initiated the contact or know the person you are dealing with.

- Be suspicious if someone contacts you unexpectedly online and asks for your personal information. It doesn’t matter how legitimate the email or website may look. Only open emails from people or organizations you know and, even then, be cautious if they look questionable. Be especially wary of fraudulent emails or websites that have typos or other obvious mistakes.

- Don’t give out personal information in response to unsolicited requests. Be particularly careful about to whom you give your Social Security number, financial account information, and driver’s license number.

- Shred old receipts, account statements, and unused credit card offers.

- Choose PINs and passwords that would be difficult to guess and avoid using easily identifiable information, such as your mother’s maiden name, birth dates, the last four digits of your social security number, or phone numbers.

- Pay attention to billing cycles and account statements and contact your bank if you don’t receive a monthly bill or statement. Identity thieves often divert account documentation.

- Review account statements thoroughly to ensure all transactions are authorized.

- Guard your mail from theft, promptly remove incoming mail, and do not leave bill payment envelopes in your mailbox with the flag up for pick up by mail carrier.

- Obtain your free credit report annually and review your credit history to ensure it is accurate.

- Use an updated security program to protect your computer.

- Be careful about where and how you conduct financial transactions. For example, don’t use an unsecured Wi-Fi network because someone might be able to access the information you are transmitting or viewing.